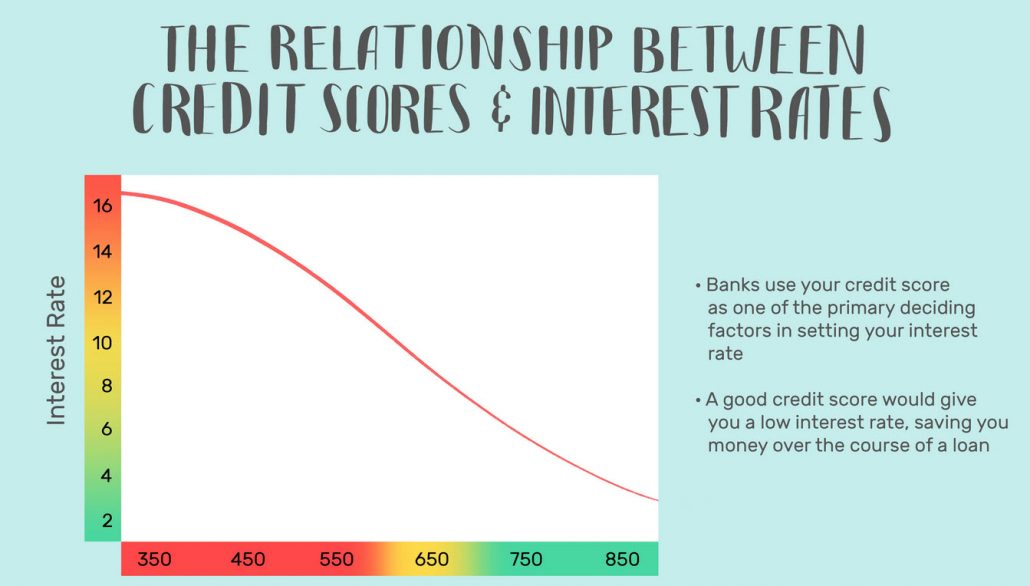

Rising interest rates are one of the most frightening things for people in debt. It is difficult to imagine how this can affect us when we have fixed repayments each month and our loans have no other debts to worry about. Yet, rising interest rates have the ability to make it impossible to pay off our debts in the foreseeable future. This makes it crucial that we know what impact it could have on our finances and consider how it will affect us. Please see the relationship with regards to Belgravia Ace Loan Information.

The magnificent villas of Tong Eng, situated at the end of a narrow road in Belgravia Drove, have been given a face-lift by the regeneration projects of the late Mr. Che Keng Chee who transformed this old and dilapidated colonial villa into a luxurious residence called Belgravia Ace that still preserves the charm of its colonial origin. Belgravia Ace project revitalized the place by completely renovating the entire building that left no stone untouched. Tong Eng Villas features Belgravia Ace villas with splendid architectural designs that can be easily appreciated by its master architects.

The interior of Belgravia Ace house is very spacious and comfortable, as it was designed keeping in mind the open plan’s concept. In fact, Belgravia Ace terrace houses has gone a step further in incorporating an outdoor pool into its design. Belgravia Ace terrace, which is located on the top floor of the building, was designed particularly to suit the needs of the pool owner as well as the residents of the villa. For Belgravia Ace residents there is an extra wide en-suite bathroom with a steam shower to wash off those excess pounds and also the large sitting room that can be reserved for entertaining guests. The spacious hall and dining area of Tong Eng Villas Ang Mo Kio are very good for gathering with friends and family.

First of all, we need to understand what interest rates are. They are the rate at which lenders lend money to their customers. They change according to economic conditions, so basically the more the economy is growing, the higher the rates will be. We know that this has a negative impact on consumers as they attempt to borrow more money to pay for essentials. Rising interest rates therefore reduce the amount of disposable income and lead to serious problems in households all around the world.

In the course of recent months, there’s been a developing worry about lodging moderateness. In spite of the downturn and pandemic, lodging costs have been on the ascent since the time the finish of the electrical switch. Resale costs for HDB pads and townhouse units have been ascending for the 10th and eighth consecutive month, individually. Factors, for example, telecommute courses of action and low loan fees have been ascribed to the value flood. It’s additionally started hypotheses of another round of cooling measures, with the public authority cautioning in January that it’s keeping a nearby watch on the property market.

But what does this have to do with our loan repayments? Rising interest rates mean that we have to pay more over the life of the loan. Of course, we could get extensions or better deals, but these options come with much higher fees. In the long run, this could prove to be very expensive. As a result, we could end up paying more for the privilege of a loan extension, or paying more for a fixed interest rate if we decide to take out an adjustable rate loan.

What’s more, since financing costs are ascending couple has cautioned that home purchasers should ponder their property buy. Increasing financing costs can be viewed as an indication of a solid monetary recuperation in the US, just as in Singapore. Truth be told, after a compression of 5.4% in 2020, Singapore’s economy is relied upon to develop somewhere in the range of 4% and 6% in 2021.

Rising interest rates will also have an effect on home loans. We all know that the cost of living is constantly rising, so the cost of our mortgages and our family’s living costs increase alongside it. If we are not careful and take out a mortgage loan at a time when interest rates are rising, we could find that the monthly repayments become unmanageable. At the worst, we may find that we cannot keep up with the repayments and our home could soon be at risk.

While this implies that a great many people will actually want to keep their positions and administration their credits, the expanded financing costs can likewise influence a little level of families in the private property area. The last gathering may confront income issues and troubles overhauling their advances. Truly, in any event, when loan costs were low, there have been developing worries about lodging reasonableness, particularly given the cost expansions in the public resale market. Middle month to month family wages have likewise dropped interestingly a year ago in over 10 years. Since financing costs are rising, what will it mean for lodging moderateness.

How rising interest rates will affect your loan is also important when it comes to looking for a new car or a home. Given today’s economic climate, many people cannot afford to buy a brand new car. As a result, lenders have increased the borrowing limits on many loans. If we want to get the best deal, or if we want to borrow more, it is advisable to consider alternative ways to borrow money.

Resale costs of HDB pads and townhouse units have been expanding for as far back as a while. It’s tracked down that general middle costs of HDB resale pads executed a year ago were about 3.9 occasions of a family’s middle yearly profit. In view of this reasonableness proportion, a family needs to put something aside for 3.9 years, with no different costs, to purchase public lodging from the resale market. The last time the proportion was this high was in 2015 and 2016. It’s additionally the first run through in quite a while that the proportion has expanded for HDB resale pads. Since financing costs are expanding, it can build your month to month contract installments, particularly in case you’re taking a bank credit. Then again, there are supports set up that guarantee you’ll actually have the option to support your credits.

As mentioned above, rising interest rates mean that we have to pay more over the lifetime of the loan. When it comes to our home, rising interest rates mean that we will have to pay more on our mortgage or rent. This will have a significant impact on our lifestyle. On the one hand, our monthly budgets will be affected. However, we should not dwell too much on this as the economy will improve in the foreseeable future. In addition, by moving home, we can be sure that our debts will be under control and that we will not be involved in any financial problems in the near future.

For example, the Total Debt Servicing Ratio (TDSR) limits your absolute month to month obligation reimbursements to 60% of your month to month pay. It covers a wide range of advances, including property advances, vehicle advances and Mastercard obligations. The TDSR guarantees that you will not be overleveraged. However long you’re spending inside your methods, the increasing financing costs shouldn’t be an over the top concern.

How rising interest rates will affect your loan is important for consumers living in rented accommodation. Rented accommodation is generally short term and you are locked into the contract until you leave. During this time period, the amount you pay for rent will have a direct impact on your finances. Therefore, you should make every effort to avoid paying more than necessary. By looking around for cheaper deals on your loan, you can ensure that you do not go into debt during the duration of your rental agreement.

There’s additionally a pressure test pace of 3.5% that banks use. So in any event, when financing costs increment, this pressure rate guarantees that borrowers can in any case bear the expansion. Also, in case you’re taking a HDB credit, you’re basically shielded from the increasing loan fees. This is on the grounds that HDB advances have a fixed financing cost, with the current rate at 2.6% for at any rate twenty years. In any case, notwithstanding every one of these systems set up, it’s a word of wisdom to design out your funds prior to focusing on an enormous buy. How would you be able to deal with fence against the increasing loan costs?

As another property holder, you can take a home credit fixed to a fixed loan cost, which banks likewise offer. Or on the other hand in case you’re a current property holder, you can consider renegotiating or repricing your home loan. A couple shaking hands in the wake of marking contract. Taking a fixed rate revenue home credit can help fence against the increasing loan fee.

Home advances with fixed rates can give you true serenity, as you most likely are aware the amount you’re paying each month. They’re additionally typically repaired for to three years, so it’s a decent alternative in the event that you favor strength. Then again, drifting rates are typically lower than fixed rates, meaning lower regularly scheduled payments. While it can assist with saving money on cost, it accompanies the danger of increasing loan fees. What to observe prior to pursuing another home advance? hether you’re another or existing mortgage holder, here are a couple of interesting points when pursuing another home advance.

There will be an adjustment of reference rate for drifting rate home advances. Those that are fixed to SIBOR will be logically changed to SORA by 2024. Short for Singapore Interbank Offered Rate, SIBOR alludes to the extended rate at which Singapore banks acquire from one another. Singapore Overnight Rate Average (SORA) depends on the real exchanges of interbank exchanges in Singapore. One reason for the change is that SORA is viewed as more steady than SIBOR. Post for the lock-in period before you reimburse your credit early, renegotiate or sell your property. This is on the grounds that there are punishments for ending the advance inside the time frame.

At the point when you’re renegotiating, don’t simply zero in on the lower loan costs and regularly scheduled payments. Renegotiating additionally accompanies its expenses, for example, legitimate charges and valuation expenses. Combined with early recovery punishments, the expenses can surpass investment funds from the lower loan costs. Rather than renegotiating, you may consider repricing. Since you’re fundamentally managing a similar bank, the interaction will be quicker, with less administrative work and expenses.

Eventually, increasing financing costs can expand your regularly scheduled payments and influence lodging reasonableness partially. However, as long as you spend and acquire inside your methods, it ought not be an over the top concern. Should you face troubles overhauling your home loan, consider renegotiating or moving toward your bank for repricing

The above examples demonstrate that how rising interest rates will affect your loan is an important consideration. It is therefore essential that borrowers understand the effect that these rates will have on their finances. Ultimately, understanding how these rates will affect your loan is essential to avoiding expensive and unmanageable debts in the future. If you are unsure as to whether you are able to meet your monthly repayments, it is advisable that you seek the advice of a debt expert to ensure that your needs are met.

Investing in Singapore condos can be a wise decision for both capital gain and rental income. With the city’s stable economy and growing population, the demand for housing is continuously on the rise. By owning a condo in Singapore, you not only have a valuable asset for capital appreciation, but you also have the opportunity to generate steady rental income. The city’s well-developed infrastructure and attractive amenities make these condos highly desirable for both local and foreign tenants. Additionally, the government’s strict regulations on property ownership and the high demand for rental units ensure a stable rental market. Condos in Singapore also offer added benefits such as access to facilities and services, providing a comfortable and convenient living experience for tenants. Therefore, investing in Singapore condos can be a smart and profitable decision for both short-term and long-term gains.